Based on our recent statewide conversations on community vibrancy, we have been diving deeper into wage research. A few weeks ago, we looked at the effects of decades of wage stagnation in Ohio, and explored public policies that could potentially promote wage growth by focusing on increasing the collective bargaining power of workers. This week, our research focus narrows down to exploring the minimum wage in Ohio.

Politicians from both sides make a lot of claims about the effects of a change in minimum wage. Some conservatives have warned us of the elimination of jobs, steep price hikes, and the death of the $5 foot-long. Conversely, some liberal outlets have argued that boosting the minimum wage would lift wages for millions of workers, stimulate the economy and reduce taxpayer spending on assistance programs. Fortunately, a wave of minimum wage hikes in 18 states means we can soon stop arguing about theoretical situations, and start digging into some actual data on what happens when the wage floor rises.

But before we dive in to the initial results of this data, I want to answer the question: Where are we now?

Current Minimum Wage

As of January 1st, 2018, the minimum wage in Ohio is $8.30 per hour for non-tipped workers. This new wage requirement only applies to companies with annual gross receipts over $305,000. The minimum wage for employees at smaller companies and for 14- and 15-year-old workers is at least $7.25—the federal minimum wage standard. A 2006 voter-approved amendment to the Ohio Constitution ties minimum wage to inflation. So each year, the wage does increase by a small amount to reflect the increase of inflation. In 2018, the increase was 15 cents per hour; in 2017, it was five cents per hour.

Early this year a bill was introduced that would increase the minimum wage to $12 per hour by 2019 and then raise it $0.50 every year until it reaches $15 in 2025. According to Hannah Halbert, a researcher with Policy Matters Ohio, 1.8 million Ohioans would get a raise if the legislation is enacted into law. However, supporters of the bill readily admitted that there is little appetite for such a move among business groups and Republicans who control the Ohio General Assembly. Meaning there’s currently little chance of this bill being passed. When asked why the Democrats would even try to introduce legislation that some consider dead on arrival, State Senator Joe Schiavoni explained that it is a way to “get the conversation going”.

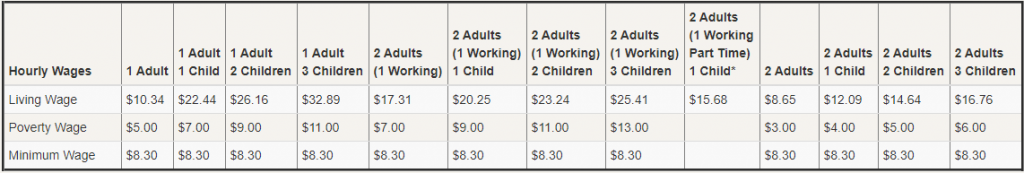

Minimum wage vs. Living Wage

Depending on where you live in the United States, the amount needed to live comfortably (known as the living wage) varies greatly. While a $45,000 salary might be sufficient for a family of three in South Dakota, you would need closer to $60,000 to keep up in Hawaii.

Interestingly, the living wage can vary greatly even at the county level. You can explore what the living wage is in your county by using the MIT’s living wage calculator, which determines the minimum amount necessary to meet basic needs without relying on outside help. The model takes into account factors such as child care and health insurance, in addition to food and other regular costs. As an example we can see Summit County’s breakdown by size of household below:

Furthermore, when we compare housing costs with wages, it helps explain why so many continue to struggle in what appears to be a vibrant economy. According to a report released by the National Low Income Housing Coalition and the Coalition on Homelessness and Housing in Ohio, said the state’s “housing wage” — the hourly wage a renter needs to earn to pay for a basic, two-bedroom unit — increased again this year to $15.25.

Effects of Increasing the Minimum Wage

In 1992, Alan B. Krueger, a professor of economics and public affairs at Princeton University, found that when New Jersey raised its minimum wage from $4.25 to $5.05, job growth at fast food restaurants was equally as strong in Pennsylvania, which did not raise wages. “If the minimum wage is set at a moderate level it does not necessarily reduce employment,” he wrote in The New York Times’ “The Minimum Wage: How Much Is Too Much?” “While some employers cut jobs in response to a minimum-wage increase, others find that a higher wage floor enables them to fill their vacancies and reduce turnover, which raises employment, even though it eats into their profits. The net effect of all this, as has been found in most studies of the minimum wage over the last quarter-century, is that when it is set at a moderate level, the minimum wage has little or no effect on employment,” Krueger wrote.

However, not all agree on the impacts of a rising minimum wage, as results of an increase could vary dramatically based on location, industry and amount of wage boost. An increase minimum wage could result in some employers simply picking up and moving, says Michael Saltsman, executive director of the conservative Employment Policy Institute. “You are already seeing some of the relocation dynamic … in places where the business is mobile, like a call center, or if it’s near a neighboring state with lower rates,” he said, citing a case where a New York business moved to Pennsylvania. But, Saltsman also conceded that for many businesses that employ people at minimum wage jobs, such as restaurants, relocation isn’t an option, and they will have to absorb the impact. If a new minimum wage is set low and close to labor costs, there would be minimal harm to business; if set too high, then damage could be significant, said Mark Schug, professor emeritus at University of Wisconsin at Milwaukee.

Until recently, most minimum wage increases at the state and local levels have been relatively marginal, which can limit their impact and therefore the evidence that could be drawn from them. However, with rates in some areas such as New York City now rising to as high as $13 an hour, nearly double the federal minimum, those effects will start to become a lot clearer. The preliminary findings of a number of new studies were shared at the American Economic Association’s annual conference in Philadelphia which evaluated the effects of some of these wage hikes. It’s important to note that the presenters all stressed that the findings were early and subject to considerable revision.

In 2017, a report from the Institute for Research on Labor and Employment, “Effects of a $15 Minimum Wage in California and Fresno,” found that a $15 minimum wage in California would increase earnings for 38 percent of the state, and businesses would see a reduction in turnover and increases in productivity. Additional findings from this study include:

Effects on businesses & consumers:

- Total wage costs would increase by 15.7 percent for restaurants and 2.8 percent across all employers.

- Employee turnover reduction, automation, and increases in worker productivity would offset some of these payroll cost increases.

- Businesses could absorb the remaining payroll cost increases by increasing prices by 0.6 percent through 2023. This price increase is well below the annual inflation rate of 1.8 percent over the past five years.

Effects on employment in California:

- Using past trends on population and employment, we project that state employment without the minimum wage increases will grow 1.40 percent annually between 2016 and 2023.

- Our estimate projects a very small increase in employment growth relative to what would occur without the minimum wage increase. This slightly higher job growth would add 13,980 more jobs by 2023, raising employment by 0.1 percent by 2023.

Another study, conducted by the Center on Wage and Employment Dynamics Institute for Research on Labor and Employment, looked at the effects of six city-level minimum wage hikes: Chicago, Los Angeles, Oakland, San Francisco, San Jose, Seattle and Washington. It compared those cities to economically-similar nearby counties. Across the cities, the paper found that wages were up while changes to employment were minimal: “We find significantly positive effects on wages and small effects on employment, consistent with many previous studies.”

Conclusion

During the Great Depression, people were facing up to a 25 percent unemployment rate and were desperate for work, so employers took advantage of this and paid very little. Because of this, the United States set a minimum wage through the Fair Labor Standards Act of 1938. The minimum wage was established to prevent that exploitation, as it helps mitigate that imbalance of power between employers and low-wage workers. Despite the importance of the minimum wage, we’ve been witnessing compensation increases at a rate that is significantly lower than the rate of inflation increases, leaving many Ohioans behind economically. At the same time, we have seen that increasing pay too dramatically or too quickly can also have negative impacts.

Further Reading: Find out what each candidate for Governor says about the minimum wage in Ohio.